The Rise of Cryptocurrency Banking: A New Era in Financial Services

The financial landscape is undergoing a significant transformation, with the cryptocurrency banking market emerging as a pivotal force. As digital currencies gain mainstream acceptance, traditional banking institutions are increasingly integrating cryptocurrency services to meet evolving consumer demands. This convergence is reshaping how individuals and businesses manage, invest, and transact with digital assets.

The Evolution of Cryptocurrency Banking

Cryptocurrency banking represents the intersection of traditional financial services and blockchain technology. Institutions are now offering a range of services, including crypto savings accounts, lending platforms, and investment products, all underpinned by secure and transparent blockchain protocols. This evolution is driven by several factors:

Regulatory Developments: Recent legislative actions, such as the GENIUS Act, have provided clearer frameworks for cryptocurrency operations, encouraging banks to venture into digital asset services.

Institutional Adoption: Major financial entities are recognizing the potential of cryptocurrencies, leading to increased investments and partnerships within the crypto space.

Consumer Demand: A growing interest among consumers in digital assets has prompted banks to diversify their offerings to include cryptocurrency-related services.

Integration with Traditional Banking Services

The integration of cryptocurrency services into traditional banking platforms is enhancing the accessibility and usability of digital assets. Services such as banking BPS are streamlining operations, allowing for seamless transactions between fiat currencies and cryptocurrencies. This integration facilitates:

Efficient Cross-Border Transactions: Cryptocurrencies enable faster and more cost-effective international money transfers.

Enhanced Security: Blockchain technology offers robust security features, reducing the risk of fraud and unauthorized access.

Broader Financial Inclusion: Digital asset services provide unbanked populations with access to financial services, promoting greater financial inclusion.

The Future Outlook

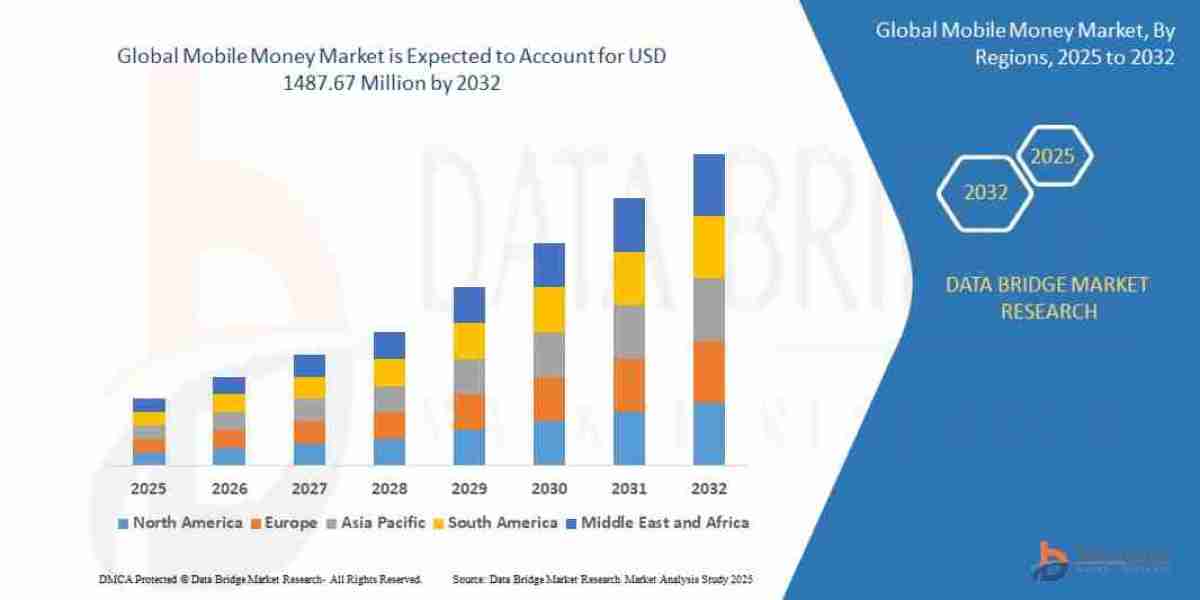

The cryptocurrency banking market is poised for continued growth. Projections indicate significant expansion as more institutions adopt digital asset services and regulatory environments become more conducive to crypto operations. Key trends shaping the future include:

Increased Tokenization: The tokenization of assets is expected to enhance liquidity and open new investment avenues.

Advancements in Smart Contracts: The development of smart contracts will automate and streamline various financial processes.

Enhanced User Experiences: Innovations in user interfaces and experiences will make cryptocurrency services more accessible to a broader audience.

As the market evolves, the role of traditional banks in cryptocurrency services will continue to expand, offering consumers a more integrated and comprehensive financial ecosystem.